Without the right mobile ad network, launching a mobile ad campaign can feel a bit like a playing a VERY expensive game of “Pin the Tail on the Donkey.” You’ve got a pretty good idea of where you want to go, but then some jerk sticks a blindfold on you. If you’ve gone through the trouble of designing the perfect mobile ad campaign, then you’d better also make sure you’ve got a trustworthy and transparent ad network—one that takes the blindfold entirely out of the equation to prove that they’re serving your ad in the best context possible.

Premium Mobile Ad Networks vs. Blind Mobile Ad Networks

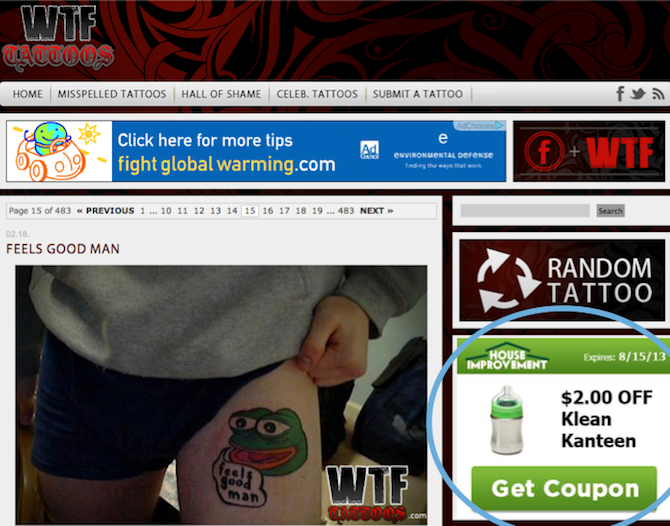

Yeah, it’s like that.

Any discussion about mobile ad networks typically boils down to comparing and contrasting two warring philosophies: Premium and Blind. Premium Ad Networks are painted as the “luxury” model; the Benz. They offer a selection of big, shiny publishers available at a premium price. Blind Ad Networks, on the other hand, are portrayed as the “economy” model; the aging Pinto you buy from that shady-looking guy out behind the Applebee’s. They offer a huge volume of smaller, less reliable publishers with a lower price tag.

The most important difference, however, is transparency. Only premium ad networks will give you a peek under the hood before you buy.

Honest Joe promises that your ad won’t appear on pornographic websites.

Once upon a time, blind ad networks were considered a sensible, economic alternative for advertisers. These networks offered a high volume of small or independent publishers, and allowed advertisers to target ads to various audience “channels” (i.e. “News”). The list of which sites and apps your ad could potentially appear on was unavailable when the purchase was made (hence the term “blind buy”), and was often also unavailable after-the-fact.

An article illustrating the dangers of this model was recently published in the New York Times:

-

“You’d ask a media company where an ad was running and they’d say, ‘We can’t pull that list,’” said Sarah VanHeirseele, agency vice president, Blue Chip Marketing. “Or they would give you a massive list but you had no way of telling if it was accurate.”

As you might expect, several classy brands soon discovered that they were being advertised on some decidedly un-classy websites. The total cost of brand devaluation from associating with these publishers is tough to measure, but there’s no question it’s still a serious issue.

Advertising on the wrong publisher can devalue your brand

Today, truly blind ad networks are all but extinct. Advertisers have gotten savvy, and ad networks now must offer some degree of transparency in order to stay competitive. Most mobile ad networks aren’t 100% premium or 100% blind, they fall somewhere in the middle. Typically, more transparency equals higher rates.

When selecting a mobile ad network, make sure you press them to actually define the extent of their transparency. Is a portion of the ad buy still going to be blind? Can you cherry pick from a list of brand safe publishers? How extensive are their analytics and reporting, and how can they back up their numbers?

Many advertisers are finding peace of mind and better ROI through fully-transparent, premium ad networks like MobileFuse. This type of network eliminates blind buys entirely, in favor of direct partnerships with high-profile publishers. Advertisers get the added benefit of serving their mobile ads on well-known publishers—in contexts that consumers know and trust—thereby boosting the perceived trustworthiness of the ad itself and making customers much more willing to take action.

Mobile Ad Network Pricing

There are three basic pricing models for mobile ad networks, usually determined by the quality of the publishers and the degree of transparency in the process.

CPC

-

In the case of blind networks, the lack of transparency is somewhat mitigated by a performance-based pricing model: advertisers only pay on a CPC (Cost Per Click) basis, and thereby eliminate the risk of paying for ads that appear in an ineffective context. If, for example, your mobile ad appears on a website where visitors are unlikely to be interested in your brand, you won’t be too strongly penalized because you are only paying for instances when customers actually click on the ad, implying interest.

CPM

-

Because premium ad networks offer better transparency (i.e. you get to choose where your ads appear), and because real estate on premium publishers tends to create a much higher value and perceived credibility for a mobile ad, advertisers pay for raw ad impressions, on a CPM (Cost Per Thousand) basis. In other words, you pay every time someone loads a webpage and your ad is served.

CPA

-

Less common and more specialized than the other two pricing models, CPA (Cost Per Action) is a performance-based pricing model like CPC, but it offers advertisers deeper customization options for exactly what they want to pay for. For example, if an advertiser wants to encourage customers to sign up for a newsletter, or download an app, then they would only pay the ad network when those actions are taken. The price is likely higher, but the risk is reduced to zero.

If you’re launching a mobile ad campaign, you might also want to check out these tips for Improving Click-Through Rate, or learn how to get the most out of geo-targeting.